International Health Insurance

Gain valuable insights and practical tips for navigating international health insurance while living abroad. From coverage details to expert advice, this comprehensive guide helps travelers…

International medical cover for expats and their families.

Medical and trip cancellation coverage for international travel.

Life insurance for globally mobile individuals living or working abroad.

Comprehensive international medical coverage for groups.

Medical, accident, and liability protection for global travel.

Financial protection for employees worldwide.

Most Popular Country Guides

Healthcare, insurance, and living insights to plan life and travel in each destination.

Healthcare, safety, and practical guidance for living abroad.

Tips and guidance for safer, smarter international travel.

Resources for global mobility, HR, and international teams.

Discover the average cost of healthcare in the U.S. and how the right travel or health insurance plan can help you manage your medical bills.

Healthcare costs in the U.S. are notoriously high; in fact, they are the most expensive in the world. You’ve likely heard stories of Americans going bankrupt due to medical bills, often because they lack sufficient insurance or none at all. Unfortunately, these stories are not uncommon and highlight a significant issue with the affordability of healthcare nationwide.

Whether you’re considering visiting the United States, preparing for a potential move, or simply curious about the country’s healthcare system, it’s essential to understand the potential financial burden you may face.

So, what is the actual cost of healthcare in the U.S.? To provide a clearer picture, we’ve compiled the latest 2024 average prices for various common procedures and treatments without health coverage, allowing you to make informed decisions before visiting the country and avoid any unpleasant surprises.

Despite its mixed reputation, the U.S. healthcare system excels in many areas. It leads the world in medical research and innovation, driving the development of new treatments, technologies, and medicines. The country is also known for its excellent emergency care and high survival rates for serious conditions like heart attacks and strokes.

Additionally, American doctors and healthcare professionals receive extensive training from some of the country’s top medical schools and programs. The U.S. healthcare system also offers patients many choices and access to the latest treatments, with a focus on personalized care.

However, high-quality care comes with a price, and healthcare costs in the U.S. are incredibly expensive. As a result, traveling to or living in the country can become extremely costly without sufficient coverage to manage the costs.

Whether you are a resident, expat, or visitor to the U.S., you can’t deny that the average cost of healthcare is much higher compared to other countries. This is not the result of a single factor, but rather a combination of issues that collectively contribute to increasing prices.

The lack of a universal healthcare system, high administrative costs, expensive medical technology, and higher prices for services all contribute to the issue. Other factors such as wasteful spending, high legal costs, and unregulated drug prices also drive up the cost of care.

Additionally, medical professionals in the United States earn higher salaries than their counterparts in other countries, which contributes to higher healthcare costs.

Some hospitals operate as for-profit businesses, which further drives up costs as they aim to maximize profits by charging higher prices for services and treatments. Moreover, doctors often conduct numerous tests out of fear of malpractice lawsuits.

All these factors combine to make healthcare unaffordable for many, especially those without health coverage, to manage the costs.

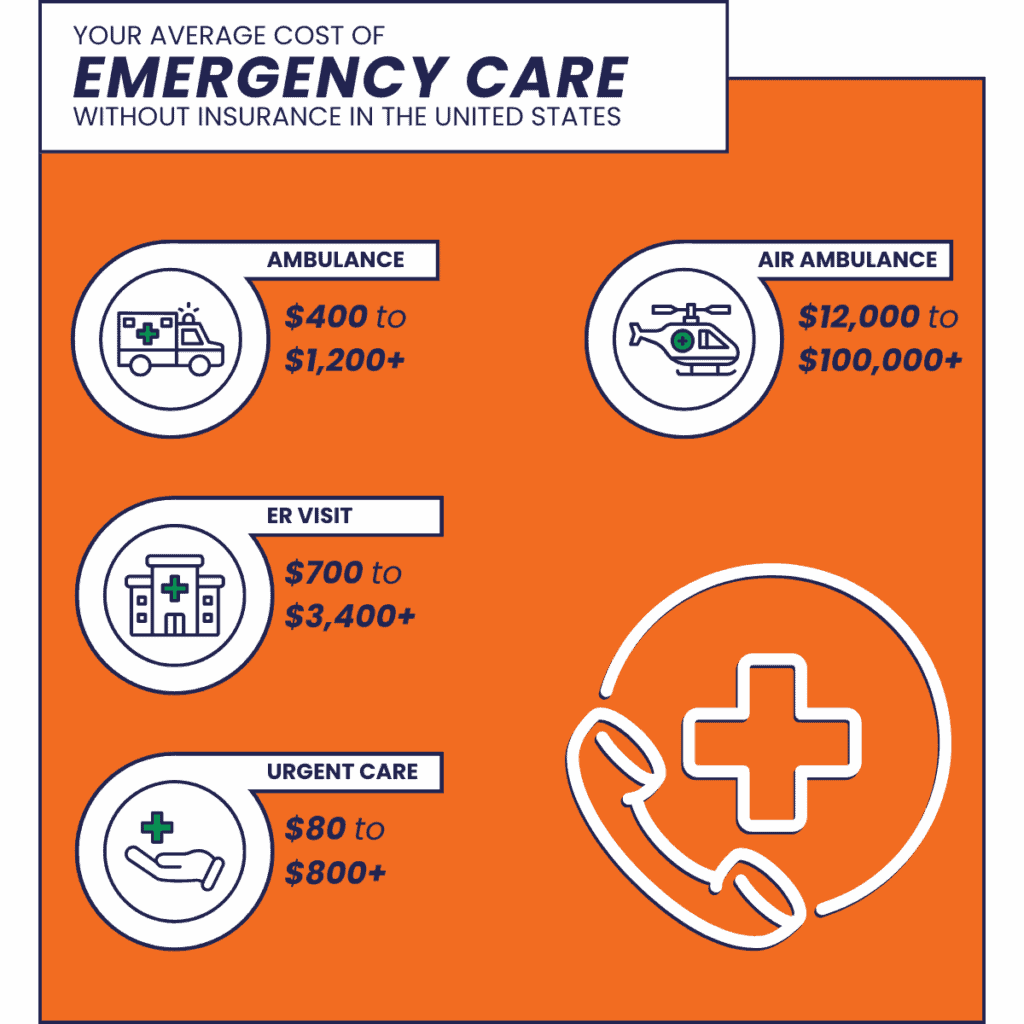

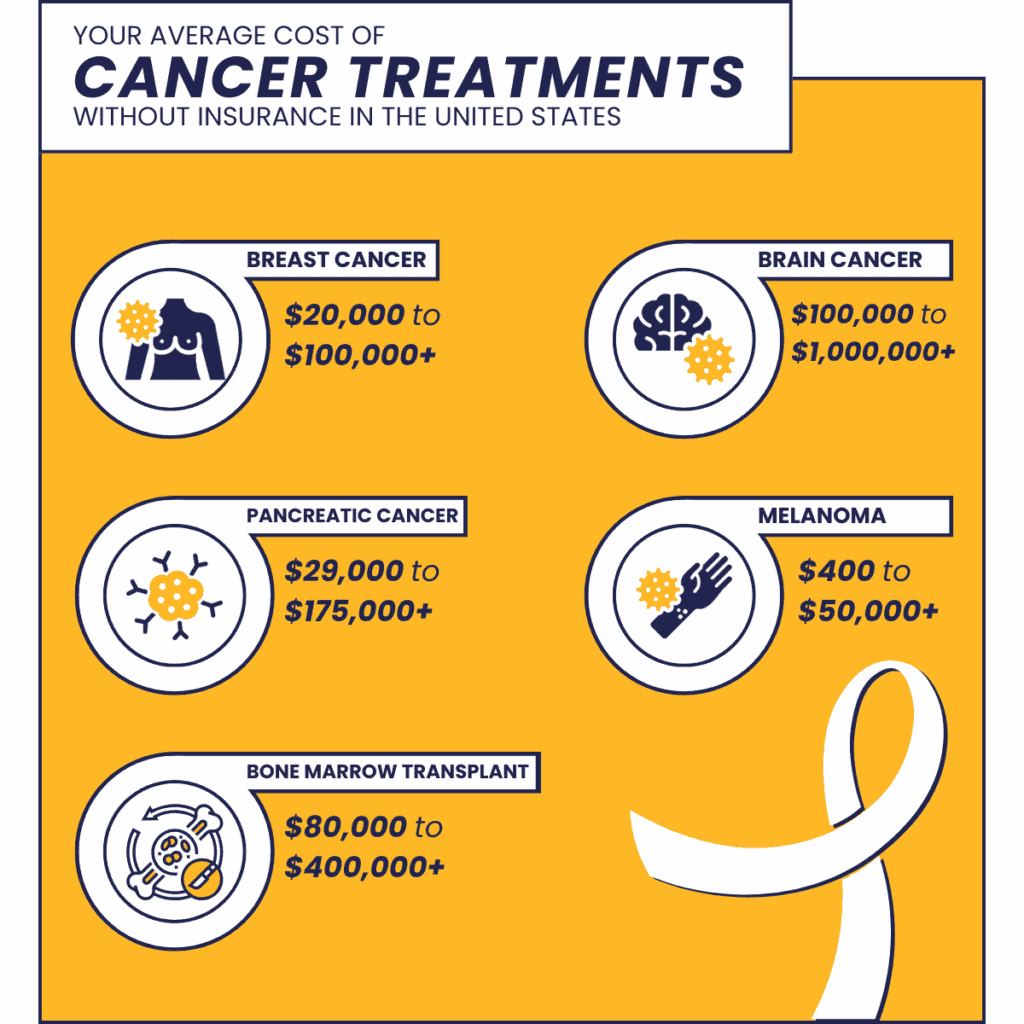

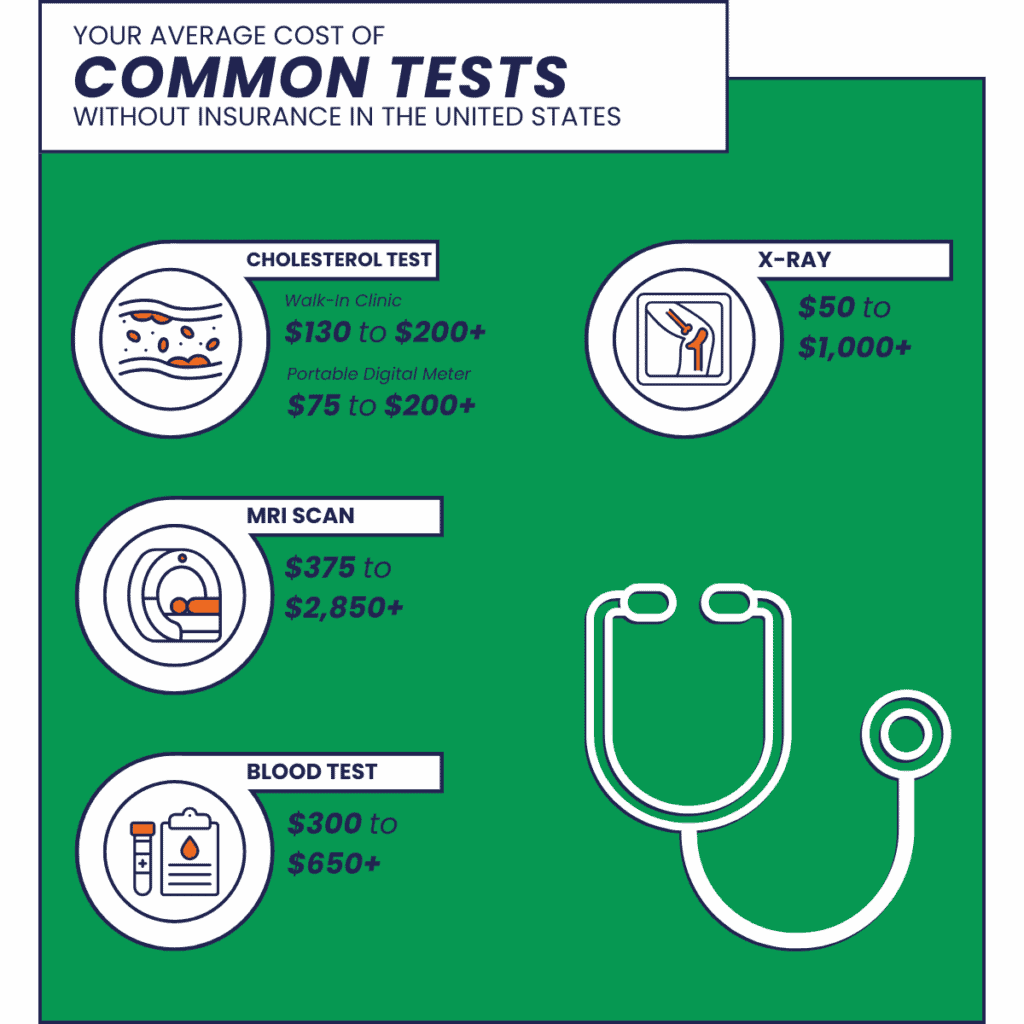

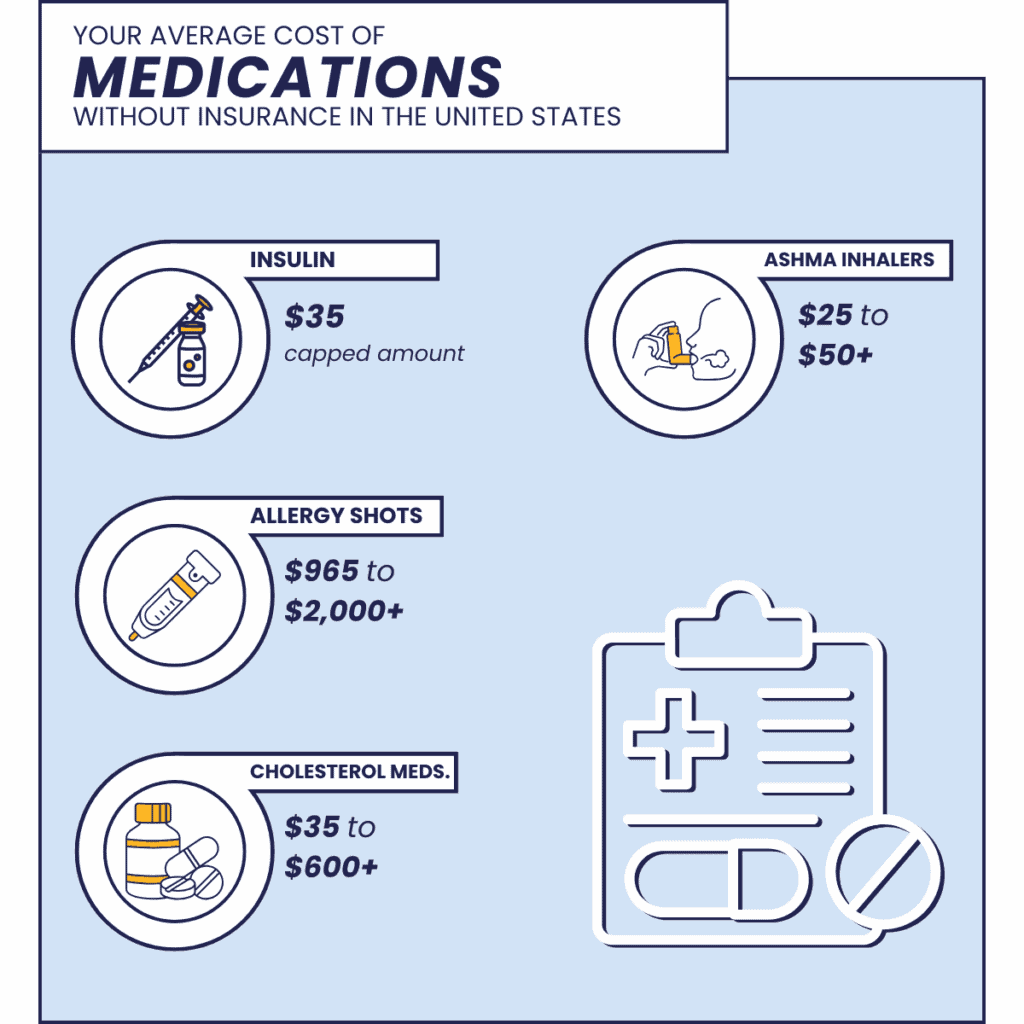

The infographics below display the average costs of common procedures in the United States, as well as the costs of unexpected medical treatments that may not be covered.

While these are estimates, and actual prices may vary depending on your location and the complexity of the care, they offer a good idea of what you might face as an expat or visitor without travel or international health insurance.

If you become ill and need emergency care, your bills will start accumulating immediately. An ambulance ride to the hospital begins at $400 and can reach up to $1,200 or more.

And that’s just for the pickup – if you need any procedures in the ambulance, the costs can add up before you even reach the hospital. If you need air transport, the expenses are even higher, with emergency evacuation starting at around $12,000 and exceeding $100,000 in extreme cases.

An ER visit can cost between $700 and $3,400, depending on the type and complexity of care you need. If you need to stay overnight, an additional $5,000 may be added to your bill. These costs vary depending on where you are treated in the U.S. and the nature of your emergency, but without coverage, they can be very expensive.

One way to save money if you need immediate attention is to go to an urgent care clinic instead of the ER. While you may still incur additional costs for treatment, tests, and medications, the visit itself typically ranges from $80 to $800 or more.

Cancer is something no one wants to think about, but it’s essential to understand the potential costs if it becomes a reality.

Unfortunately, cancer care in the U.S. is very expensive. For example, early-stage melanoma might cost as little as $400, but without coverage, the cost can rise to $50,000 or more.

Breast cancer costs can vary widely depending on the stage at which it is detected, but tend to start around $20,000 and can exceed $100,000.

Pancreatic cancer treatment can range from $29,000 to $175,000, while a bone marrow transplant can cost as much as $400,000 or more. Meanwhile, the price of treating brain cancer can exceed $1 million.

Lab tests are often essential when a doctor is trying to diagnose your medical issues. However, this is another area where the cost of U.S. healthcare can be high.

Without coverage, routine blood work can cost anywhere from $300 to $650 or more. If you just want to check your cholesterol levels, a lipid panel can range from $130 to $200 at the lab, or $75 to $200 for a portable digital meter to use at home.

An MRI scan can range from $375 for the simplest imaging to $2,850 or more for a full body scan. While X-rays are generally more affordable, sometimes costing as little as $50, they can exceed $1,000 depending on the circumstances.

American healthcare prices are also high when it comes to prescription medication, though there have been some recent improvements.

For example, insulin for diabetes is now capped at $35 per month, even without coverage. Following a price hike crisis, the cost of asthma inhalers is also more controlled, with prices ranging from $25 to $50.

However, prices for other medications can still vary widely depending on several factors. For instance, cholesterol medication may cost between $35 and $600 per month, while a year’s worth of allergy shots can range from $965 to over $2,000.

Prescription drugs can account for a significant portion of a patient’s budget, which is why many insurance plans include coverage for these costs.

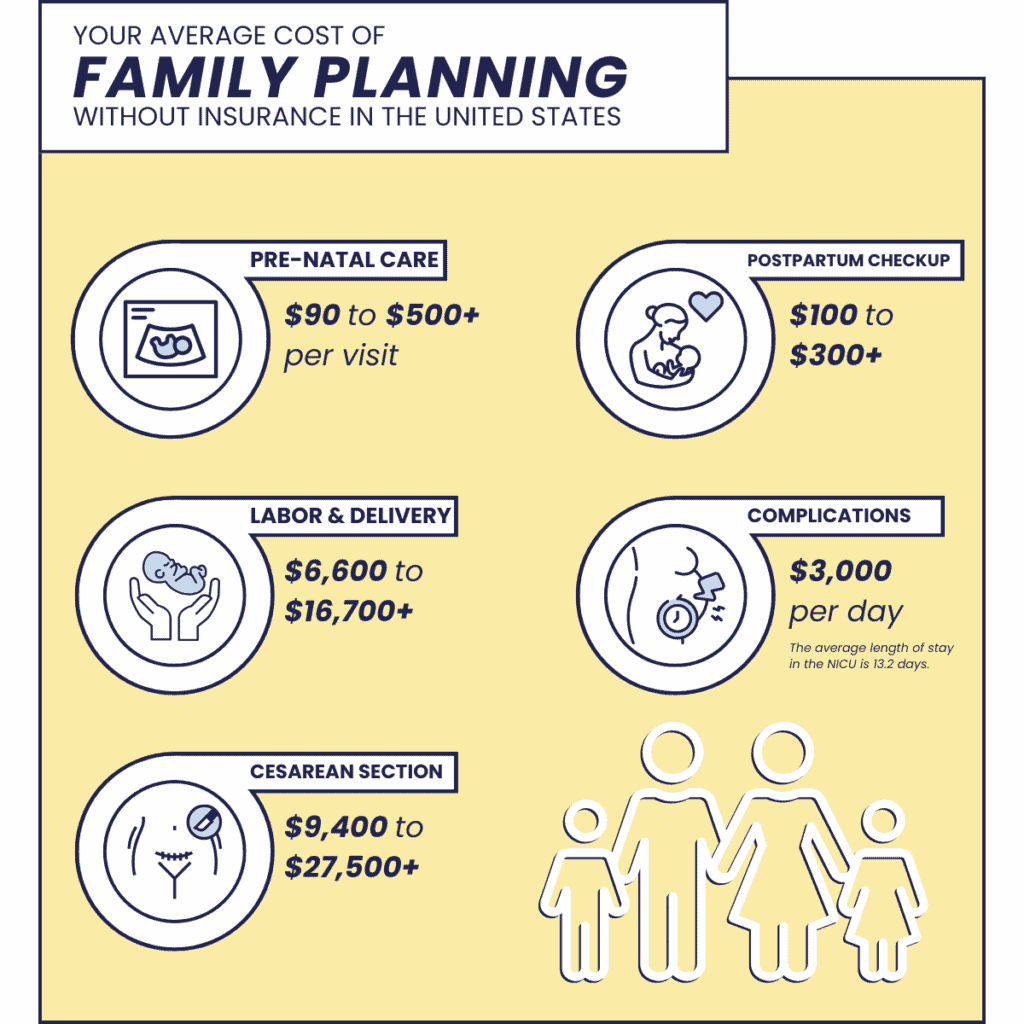

The United States is a notoriously expensive place to have a baby, and if you decide to start a family or add to it while living in the country, your healthcare costs will quickly add up.

Prenatal doctor visits generally cost between $90 and $500 each time, and you will need several of them throughout your pregnancy.

Labor and delivery alone can cost anywhere from $6,600 to $16,700 – and that’s for a vaginal delivery. A cesarean section, whether planned or emergency, is more expensive, ranging from $9,400 to $27,500 or more.

If there are complications and your baby needs a stay in the NICU, you can expect to pay around $3,000 per day without coverage. Given that the average NICU stay in the U.S. is 13.2 days, this could result in a staggering total bill of $39,600.

Postpartum checkups have similar costs to prenatal ones, ranging from around $100 to $300 per visit. Overall, pregnancy and childbirth in the U.S. are very costly, so having health coverage is crucial.

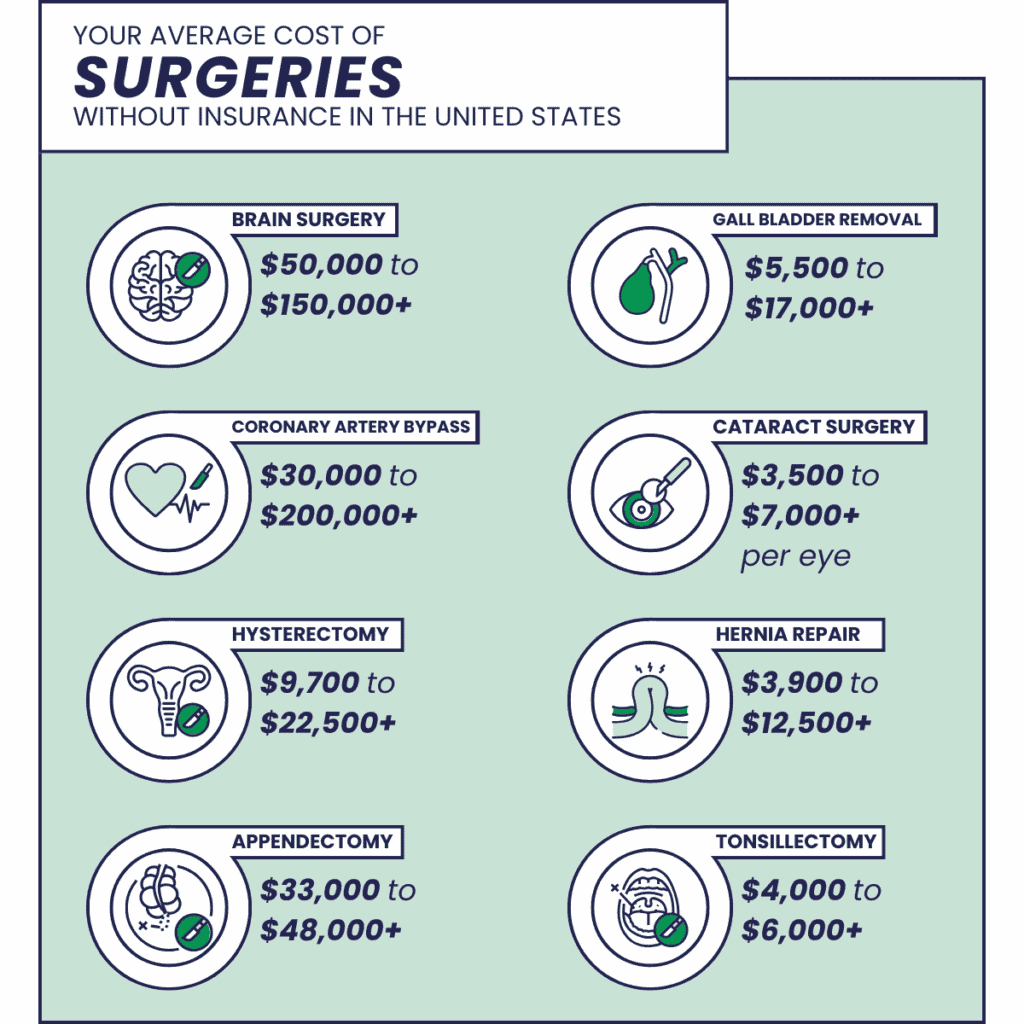

Whether you need emergency surgery like an appendectomy or elective surgery for cataracts, the costs in the U.S. are incredibly high.

While it can be challenging to determine the exact figures, as they vary depending on a range of circumstances and fees, an appendectomy typically costs between $33,000 and $48,000 or more. Meanwhile, cataract surgery can cost between $3,500 and $7,000 per eye, or more.

More common procedures, such as a tonsillectomy, are somewhat cheaper, costing between $4,000 and $6,000. If you need your gallbladder removed, you can expect to pay at least $5,500. However, factors such as your metro area and the complexity of the surgery can increase the cost to as much as $17,000.

A hysterectomy can be even more costly, ranging from $9,700 to $22,500 or more. As you might expect, a specialized and life-saving procedure like a coronary artery bypass can cost anywhere from $30,000 to over $200,000.

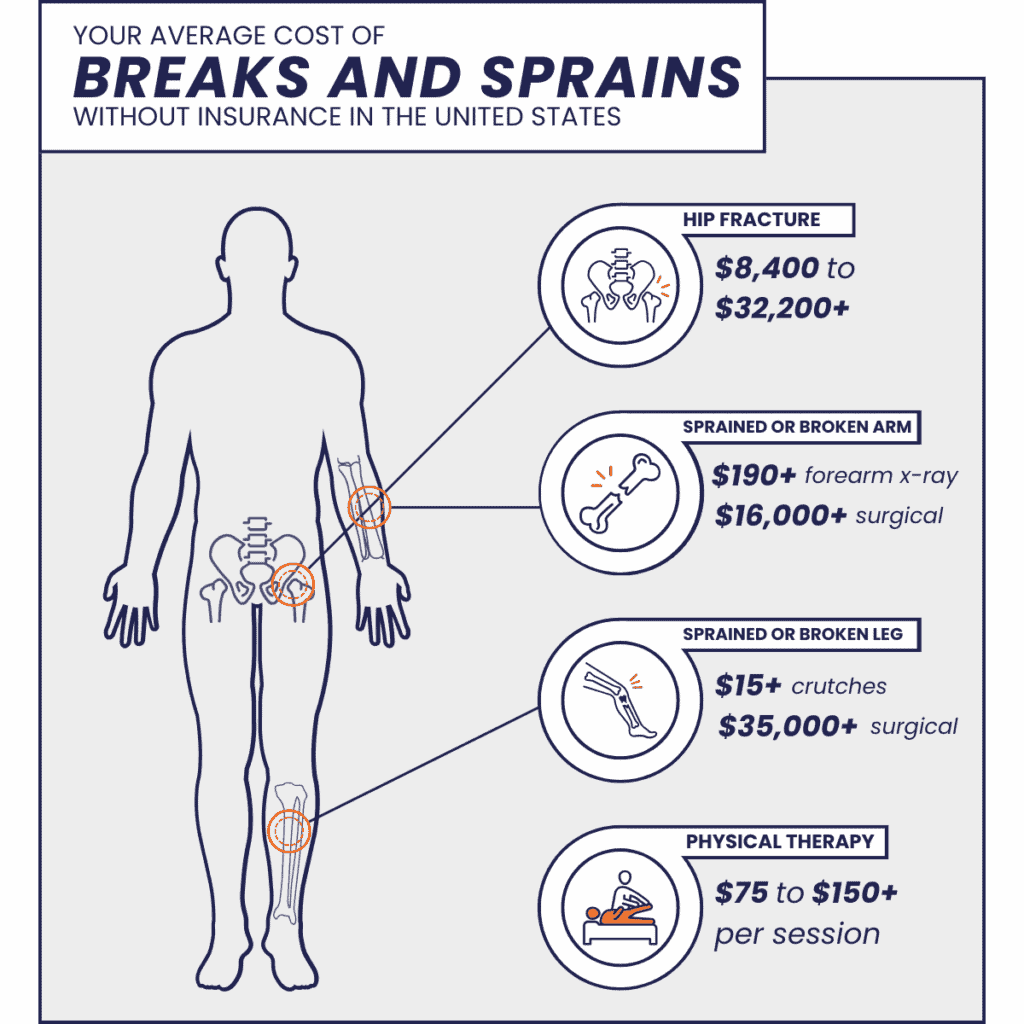

It could be anything from a simple fall on the sidewalk to a serious sports injury. Whatever the scenario, breaks and sprains can happen at any time and can be very expensive to treat in the U.S. if you don’t have adequate coverage.

Like other types of medical care, costs can vary widely depending on where you are, how badly you’ve been hurt, and the type of treatment you need. If you sprain or break your arm, you could pay anywhere from $190 for a forearm X-ray to $16,000 or more for surgery.

A leg or ankle sprain may set you back as little as $15 for a set of crutches, but major surgery for a severe fracture can exceed $35,000.

Breaking your hip can result in costs ranging from $8,400 to $32,200. And even after the bones heal, you’ll probably need some physical therapy to regain full function, with each session averaging $75 to $150 or more.

A visit to a doctor’s office is relatively affordable in the U.S. However, if you are ill, additional costs can quickly add up. This might include fees for diagnostic tests, procedures, and follow-up visits.

An initial consultation with a primary care doctor generally ranges from $100 to $200. Specialist visits are typically more expensive, with consultations averaging $250 or more, depending on the specialty and the nature of your visit.

Costs can vary significantly based on whether you have health coverage and the specifics of your plan. For urgent issues, urgent care centers can offer a more affordable option than emergency rooms, with visits generally costing between $150 and $300.

As a frugal traveler or expat, you may be wondering how to reduce your healthcare costs without compromising quality or convenience.

Firstly, remember that common over-the-counter medications and first aid supplies are widely available and very affordable in the United States.

For example, you can find headache medication, mild heartburn medication, muscle cream, sinus decongestants, and skin ointments for under $25, with some items costing as little as $5. Consulting a pharmacist is also free, and they can offer valuable advice on treating minor, non-urgent conditions.

Secondly, ensure that you have adequate travel insurance or health coverage while in the U.S. As you’ve seen above, if you fall ill while visiting the country, a relatively uncomplicated problem, such as an inflamed appendix, can cost several times more than the trip itself.

Similarly, as an expat, you may face significant medical expenses without proper coverage, which can lead to financial strain and unexpected burdens.

With the right plan, you can avoid worrying about facing a serious health problem and incurring staggering medical bills afterward.

Proper coverage will also prevent you from being overwhelmed by high costs in an emergency, which is stressful enough to deal with.

If you never go to the doctor, you won’t face these high medical costs, and some people feel comfortable taking that risk. However, for most people, the risks are too significant. For expats in the US, buying international health insurance is the best way to offset that risk.

Although a plan requires you to pay a fixed monthly premium, even if you don’t visit the doctor, it is well worth it for the peace of mind it provides.

It ensures that you are covered for medical services outlined in your policy, such as doctor visits and hospital stays, up to the specified limits and conditions.

A high-quality health plan will cover all your costs, minus a deductible (the amount you pay before coverage kicks in), an excess (the additional amount you may need to pay), and/or a co-pay (a fixed amount you pay for a covered service, such as a doctor’s office visit after you’ve met your deductible).

Plans with higher deductibles and co-pays generally have lower monthly premiums. This means you’ll pay less each month but more out-of-pocket when you use medical services.

On the flip side, plans with lower deductibles and co-pays usually have higher monthly premiums, meaning you pay more each month but less when you use medical services.

Depending on the plan you choose, it may cover all your medical costs without any limit. However, some plans place a cap on the amount they will pay for your medical expenses, known as a medical maximum.

Plans with a lower medical maximum generally have lower monthly premiums, but in exchange, you will take on more risk because if your medical bills exceed the cap, you’ll be responsible for paying the extra costs yourself.

Due to all these factors, the cost of health coverage in America can vary significantly. An international health insurance plan typically costs more than a travel medical insurance plan because it provides more comprehensive medical coverage.

On average, our clients pay about $500 per month for a comprehensive global medical plan. While this may seem high, it’s often more affordable than paying a $10,000 medical bill out of your own pocket.

There are various coverage options available for foreigners in the United States, depending on their individual circumstances.

If you are planning to relocate to the country, you can opt for a global medical plan that provides basic coverage for common ailments or a more comprehensive plan that covers a wider range of services. You can also choose from several tiers to meet your needs and budget.

If you are visiting the U.S., there are a range of plans designed to cover emergency medical expenses in the event of illness or injury, requiring hospital care. These options provide excellent value, offering peace of mind at a cost far lower than the potential risk of incurring large medical bills.

You can find more detailed information about these plans in our articles on US health insurance for non-citizens and safety and travel insurance for the U.S.

If you are moving to the United States, planning a trip to the country, or need coverage for any reason, our team of licensed brokers can help you research, compare, and purchase the right plans for your needs and budget.

We offer some of the best international health insurance, travel medical insurance, group insurance, and travel insurance policies to people from all around the world.

*Disclaimer: The information shown in these infographics was last updated in August 2024. The data is intended to aid decision-making. Medical costs and charges are subject to change at any time and can vary significantly by geographic location and insurance plan.