The Healthiest Countries in the World in 2026

Looking to move abroad? Discover the healthiest countries in the world in 2026, based on healthcare, diet, air quality, and happiness.

International medical cover for expats and their families.

Medical and trip cancellation coverage for international travel.

Life insurance for globally mobile individuals living or working abroad.

Comprehensive international medical coverage for groups.

Medical, accident, and liability protection for global travel.

Financial protection for employees worldwide.

Most Popular Country Guides

Healthcare, insurance, and living insights to plan life and travel in each destination.

Healthcare, safety, and practical guidance for living abroad.

Tips and guidance for safer, smarter international travel.

Resources for global mobility, HR, and international teams.

Learn how to navigate the US healthcare system and access medical care as an expat or visitor to the United States.

The United States is home to some of the world’s most advanced medical technology and quality healthcare services. However, for foreigners, whether visiting briefly or living long-term, the U.S. healthcare system can be complex, confusing, and costly to navigate.

Unlike many countries with universal healthcare, the U.S. relies heavily on a mix of private insurance, government programs, and out-of-pocket payments. Without a clear understanding of typical costs and options, it’s easy to encounter unexpected bills or barriers to care.

This article explains how healthcare works in the U.S., breaking down key costs and practical tips to help foreigners confidently access medical care during their stay.

The U.S. healthcare system is a vast and complex network of both public and private providers, including nonprofit and for-profit hospitals, clinics, specialty centers, university medical centers, and independent practices.

While many facilities are privately owned, some are government-run, and funding comes from a combination of public programs, private insurance, and patient direct payments.

Unlike many developed countries, the U.S. does not provide universal free healthcare. Instead, most medical services require out-of-pocket payments or insurance coverage.

While some cities and states offer free or low-cost clinics, access to these services is limited and varies significantly across the country.

As a result, most Americans rely primarily on health insurance to cover their medical expenses, often supplementing this coverage with out-of-pocket costs.

Both federal and state governments shape healthcare policy in the U.S. The federal government sets nationwide standards and regulations, while states have significant control over the implementation of local healthcare.

This results in wide variation in access and policies across states. For example, Massachusetts has strong healthcare policies and funding aimed at expanding coverage and reducing the number of uninsured residents.

As of January 2025, the federal government has been restructuring national health agencies and introducing new regulations to improve the system.

Public healthcare support is available at the federal level for specific groups, including veterans, seniors aged 65 and over, and people with disabilities.

Medicaid also covers specific populations, including children, pregnant women, and low-income individuals, but eligibility and benefits vary by state. Enrollment is not automatic; applicants must apply and prove their citizenship or legal residency.

The Affordable Care Act (ACA), enacted in 2010, also expanded access to health insurance and established a government-run marketplace for individuals to purchase coverage.

The U.S. healthcare system is primarily private, with most hospitals and medical practices being privately owned.

According to the U.S. Census, over 65% of Americans rely on private coverage to access a combination of private and public healthcare services.

Private facilities often offer specialized care and amenities that are not available in public settings.

Private healthcare services range widely, from basic checkups to concierge-level care. Having a primary care provider (PCP) is essential for preventive care and coordinating specialist visits, especially for families.

Patients frequently use online reviews to choose providers, and many healthcare professionals in the U.S. are internationally trained, making it easier for expats in large cities to find doctors who speak their language.

While waiting times to see specialists exist, they are generally less than 30 days. Federal regulations require insurers to approve urgent care within 72 hours and standard care within seven days.

Private healthcare is mainly funded through health insurance premiums paid by employers and individuals, supplemented by out-of-pocket expenses, especially for elective or non-emergency care.

Most hospitals operate as privately owned nonprofit organizations, although some are government-run or for-profit.

Federal and state regulations influence healthcare costs in the private sector. However, pricing and billing can vary widely between providers, making it essential for patients to understand their coverage and costs in advance.

The U.S. healthcare system offers some of the most advanced medical services in the world, particularly in complex and specialized fields.

Each year, between 100,000 and 200,000 international patients travel to the United States for treatments that may be unavailable or less accessible in their home countries, highlighting the country’s cutting-edge medical capabilities.

The 2024 U.S. News & World Report ranked the United States 19th globally for well-developed public health systems, placing it within the top 25 worldwide and ahead of several European countries struggling with overburdened healthcare systems.

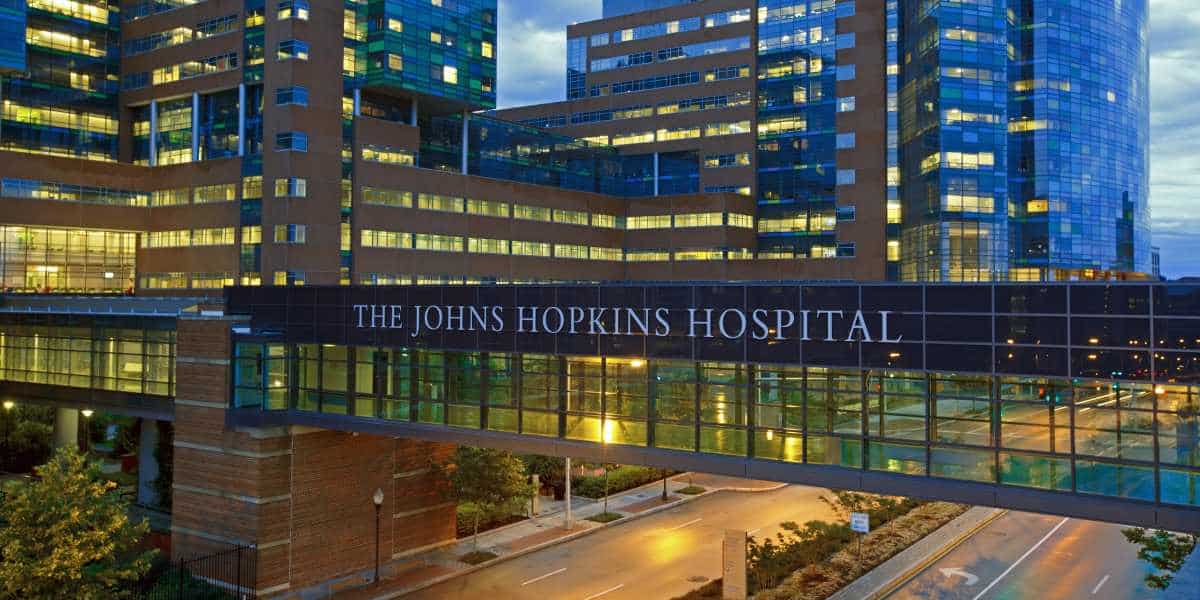

Nearly 20% of the world’s top hospitals are located in the U.S., including prestigious institutions affiliated with major universities, such as Johns Hopkins Hospital in Baltimore and Stanford Health Care in California.

However, this level of care comes at a high cost. The U.S. spends more per capita on healthcare than any other developed nation and allocates a larger share of its GDP to health services than most wealthy countries. For patients without comprehensive insurance, costs can be exceptionally high.

Below is an overview of the main advantages and drawbacks of the U.S. healthcare system.

Despite the high costs, patients benefit from several key advantages, including:

Despite its many strengths, the U.S. healthcare system also faces significant challenges that affect patients nationwide.

Access to healthcare in the U.S. as a foreign national depends heavily on your immigration status, length of stay, and the state in which you reside.

Foreign visitors are not eligible for Medicare or Medicaid, and most “lawfully present immigrants” must wait five years before qualifying for these programs.

Additionally, the U.S. does not have reciprocal healthcare agreements with other countries, so any public or universal coverage from your home country does not apply while you are in the U.S.

Some states have more inclusive policies. For example, California allows all residents, regardless of immigration status, to enroll in Medi-Cal, the state’s Medicaid program.

Enrollment in public healthcare programs is not automatic. Applicants must apply, provide proof of citizenship or legal residency, and meet eligibility criteria, which vary by state.

If you plan to live and work in the U.S. for six months or longer, securing health insurance is essential for non-U.S. citizens. While federal law does not require expats to carry insurance, some states impose tax penalties if you don’t.

Here are your main insurance options as an expat:

Visitors cannot access public healthcare programs and must rely on emergency care in the event of an urgent situation.

U.S. hospital emergency rooms are required to treat patients regardless of ability to pay, but the costs can be very high and often require upfront deposits.

Because medical bills can quickly add up, purchasing travel medical insurance before your trip is strongly recommended.

Even if you’re eligible for a U.S. health plan, be aware that coverage is typically limited to a specific state or region. A global medical plan may offer better protection if you plan to travel within the U.S. or spend time abroad while based there.

If you plan to travel across different states or visit other countries while using the U.S. as a home base, choose a travel insurance plan with nationwide and international coverage, as most U.S.-based plans limit care to one region.

If you are visiting the U.S. briefly, consider visiting a travel clinic that specializes in care for international travelers. You can find them in most large U.S. cities or search using the Global Travel Clinic Directory from the International Society of Travel Medicine.

If you are visiting the U.S. briefly, consider using a travel clinic specializing in care for international travelers. You can find them in most large U.S. cities or search using the Global Travel Clinic Directory from the International Society of Travel Medicine.

Hospital emergency rooms are legally required to treat all patients, but emergency care is costly and must be paid for out of pocket by uninsured foreigners. Urgent care clinics are usually a more affordable alternative for non-life-threatening issues.

Many expats and residents have a primary care provider for preventive care and general health needs. Seeing specialists often requires referrals from your PCP, depending on your insurance plan. It’s essential to confirm that your doctors and clinics accept your insurance to avoid unexpected costs.

Learn what to do in an emergency and how to access hospital treatment in our article on Hospitals in the United States.

Most adults in the U.S. establish care with a PCP for routine health needs like screenings, immunizations, and chronic condition management. Parents typically register their children with a pediatrician for regular check-ups and to address acute illnesses.

Dental and vision services are typically not covered by standard health insurance. However, most plans allow you to visit dentists and optometrists without a referral, and make sure they’re in-network for your specific dental or vision coverage.

Pharmacies are the go-to places for over-the-counter and prescription medications in the United States. They may be independent small businesses or part of major regional or national chains, such as Walgreens and CVS. Many clinics and large grocery stores also include an in-house pharmacy.

Over-the-counter medications are available at pharmacies, big-box stores, and online retailers. When shopping for typical medications, check whether a lower-cost generic equivalent is available.

If you bring prescription or over-the-counter medications from your home country, keep them in their original labeled containers.

The U.S. Food and Drug Administration (FDA) recommends bringing a supply of no more than 90 days. It’s also a good idea to carry a doctor’s note in English explaining why you need the medication.

Larger U.S. pharmacies often offer additional services like illness testing and treatment, health screenings, and vaccinations. Many have in-store clinics staffed by nurse practitioners or physician assistants and offer extended hours, including evenings and weekends.

In the U.S., vaccinations are available at pharmacies, doctors’ offices, and clinics. Most health plans cover standard vaccines.

Travelers to the United States are not required to receive any mandatory vaccinations. However, many countries recommend updating routine immunizations before traveling, such as vaccines for measles, mumps, and rubella (MMR), as well as COVID-19.

It’s wise to consult your doctor for personalized advice and to bring documentation supporting any medications or prescriptions you are taking.

If you are immigrating to the U.S. and applying for permanent residency, certain vaccinations are required. For details on state-specific vaccine rules, refer to this list.

Healthcare in the U.S. is notoriously expensive, especially without insurance. Even basic treatments can be extremely costly. For example, visiting a doctor without insurance may cost 2 to 4 times more than if you are insured and in-network.

Prices vary by location, with higher costs in states like Connecticut, New York, or Hawaii.

Below are average price ranges (in USD) for common services:

Even with insurance, most people pay some portion of their medical bills. Typical out-of-pocket expenses include:

Although out-of-pocket spending accounts for about 6% of total U.S. healthcare expenditures, it can be a significant burden, especially for those without insurance.

You usually pay copayments and prescription costs upfront. However, providers will bill your insurance to determine coverage and your remaining balance for more complex care, such as surgery or hospitalization.

Sometimes, you may need to pay first and seek reimbursement later. Providers of elective care, like dentists, opticians, or cosmetic surgeons, may offer payment plans or financing, often with interest.

If your insurer declines coverage, you will be responsible for the full cost. There is no fallback public healthcare system or financial assistance for foreign visitors. Because of this, most travelers and expats consider U.S. health insurance essential.

Many patients negotiate their medical bills or request payment plans for expensive services, such as surgeries or hospital stays. If you receive a bill, contact the provider’s billing department to ask for an itemized statement or to discuss payment options. Charges like lab fees or service fees are often negotiable.

Visitors do not need to register to receive emergency care, as hospitals and clinics are required to treat all patients. Long-term residents typically select healthcare providers through their insurance plans.

While primary care providers (PCPs) usually do not charge a formal registration fee, some may charge administrative fees during initial visits.

Most U.S. insurers require documentation such as:

If your insurance is employer-sponsored, your employer can often assist with the paperwork and help you obtain a Social Security number.

Processing new insurance applications can take up to 90 days; however, enrolling during open enrollment periods can expedite the approval process. Once registered, you will receive an insurance card and access to provider directories and plan resources.

For expats and visitors to the United States, having quality coverage is the only way to access medical care without facing extremely high costs. Be sure to secure the right coverage before you travel or move.

Wherever you are in the U.S., know the location of the nearest urgent care clinic and the closest hospital in case of an emergency. It’s also vital to confirm in advance that your insurance covers treatment at those facilities.

The U.S. is a vast and incredibly diverse country with so much to see and experience. Whether you’re visiting for a week or planning to stay for years, taking care of your health will help you make the most of your time there.

If you’re unsure which plan to choose, we can help guide you through the process. Speak with or email one of our licensed brokers for personalized advice. We work with trusted international insurers and offer free quotes to help you compare plans and find coverage that meets your needs in the U.S.

Envisage International and International Student Insurance (ISI) have created a six-minute video explaining how the U.S. healthcare system works. It highlights common challenges and provides helpful tips for maintaining good health while in the country.

While the video is designed for international students, the information is also helpful for anyone new to the U.S. It includes advice on preparing for your stay, examples of medical costs, guidance on finding healthcare providers, and explanations of key insurance terms.