Countries With the Highest and Lowest Life Expectancies

Discover life expectancy by country in 2026 and how healthcare, lifestyle, and other key factors impact longevity and well-being worldwide.

International medical cover for expats and their families.

Medical and trip cancellation coverage for international travel.

Life insurance for globally mobile individuals living or working abroad.

Comprehensive international medical coverage for groups.

Medical, accident, and liability protection for global travel.

Financial protection for employees worldwide.

Most Popular Country Guides

Healthcare, insurance, and living insights to plan life and travel in each destination.

Healthcare, safety, and practical guidance for living abroad.

Tips and guidance for safer, smarter international travel.

Resources for global mobility, HR, and international teams.

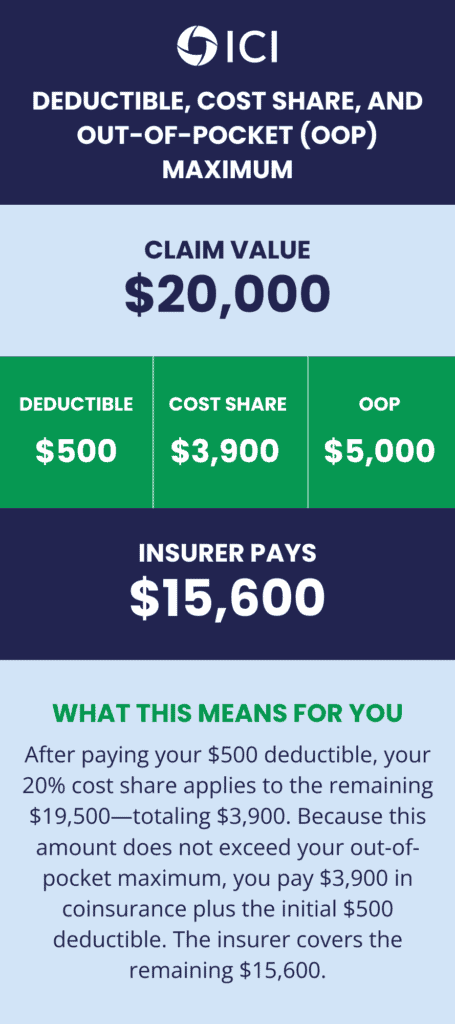

Learn how deductibles, cost shares, and out-of-pocket maximums work in global health insurance, and how they impact your premiums and claims.

When you purchase an international health insurance plan, you may have the option of choosing a deductible amount. We are often asked: How do deductibles work? If, for example, you choose a deductible of $250, you’ll need to pay the first $250 of a covered claim(s) in any period of coverage directly to your hospital, clinic, or doctor at the time of treatment.

So, if your treatment costs are $500, you’ll need to pay $250, and your provider will pay the remaining $250 of covered costs. If a deductible is chosen, you would only have to pay this once during any period of cover, regardless of the number of claims.

Cost share (also known as coinsurance) is the percentage of each claim that you’re responsible for paying. This is different from a copay, which is a fixed amount you pay for specific services like a doctor visit or prescription.

Your out-of-pocket maximum is the most you’ll pay in cost share during a single policy period. Once you reach that limit, the insurance company covers 100% of your eligible medical expenses.

Example:

In this case, you would pay a total of $4,400:

The insurance company would cover the remaining $15,600.

Once your deductible and cost share are met, your plan typically covers 100% of all additional covered expenses for the rest of the policy period.

There are a variety of factors that will affect the cost of your insurance plan, including your age, where you are from, where you are living, and the deductible or cost-share amount you choose to include in your policy.

A higher deductible or cost-share will lower your premium. As you agree to pay more out of your pocket for potential medical expenses, the cost to the insurer is reduced, and they share some of that benefit with you when you purchase the plan. However, it is not a dollar-for-dollar reduction, and each insurer will handle deductibles and premiums differently.

Often, customers are surprised to find that if they choose a $1,000 deductible, their premiums are only reduced by a percentage of that amount – often much less than expected.

The insurer maintains a high level of risk when you purchase a policy, and a $1,000 deductible is only a small portion of that total risk, so they do not deduct that full amount from your premium.

Some plans provide a benefit called Deductible Carry Forward or Carry Over. This allows the client who purchases the coverage to receive credit for expenses paid at the end of their policy period toward expenses incurred at the beginning of their new policy period.

As described in the policy certificate for the IMG Global Medical Plan: “If the Deductible has not been met during the Period of Coverage, then Expenses incurred during the last 30 days of the Period of Coverage will be applied toward satisfaction of the Deductible for the next Period of Coverage.”